Introduction to Retirement

Retirement isn’t as simple as getting to stop working at age 65, as lovely as that would be. Retirement can actually be broken down into multiple unique stages. Each of the retirement stages has its own key things to remember and to save for.

It’s Never Too Early

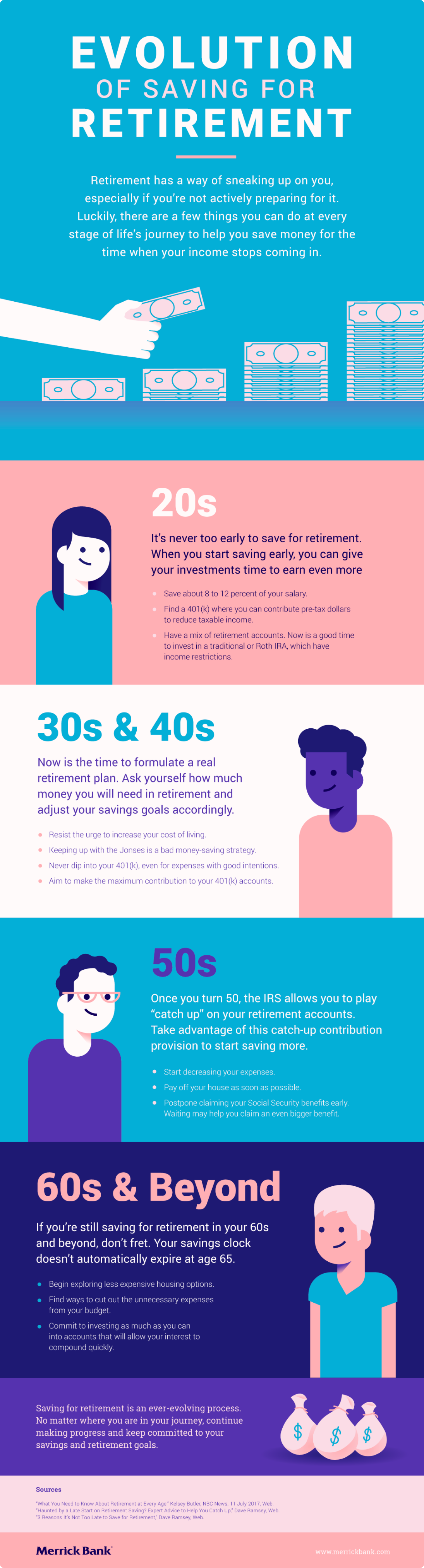

When you look up the retirement stages, they often start with someone being in their 50s, but it’s never too early to start saving. When you start saving early, you can give your investments time to grow and earn more money. When you're creating your budget for the year, always try to factor in a percentage of your salary to go into your retirement fund. Aim for 8 to 12 percent if possible, but anything is better than nothing. Put that money in a 401(k) where you can contribute pre-tax dollars to reduce taxable income.

When Should I Formulate a Solid Retirement Plan?

There’s a difference between just putting money away and having a plan for what to do with it. Now’s the time to sit down and work out what you want from your retirement and how much money that will take. If you are struggling with your plan, don’t hesitate to ask those around you for help or ideas! Once you have that answer, you can start taking the steps necessary to ensure you have the retirement you deserve. Always keep your plan for the future in the back of your mind and ask yourself if doing things like increasing your cost of living will take away from your retirement.

In-Depth Dive Into the Stages of Retirement

No one person is the same, so there’s no way to know exactly how each retirement stage will go. But here’s an outline to guide you and help you be prepared going forward!

Pre-Retirement Stage

Once you hit 50, you enter the pre-retirement era. This means you’re about 10 or so years away from when you plan to retire. If you haven’t planned out your retirement before, this is the time to do so! If you’ve planned ahead and know what you’re going to do with your retirement, do a deep dive into your finances and see whether or not you’re on track. No matter where you’re at, adjust your saving and spending as needed. This helps ensure that your budget is set up to help you achieve your long-term goals.

Early Retirement

If you’re still saving for retirement in your 60s and beyond, you don’t need to fret! There are no rules on how to retire, and your savings clock doesn’t automatically expire at age 65. If you have concerns about your income and savings, consider returning to work either part-time or full-time. You can also see if a hobby you already love can help you bring in extra income in the form of selling your work or teaching a class! Even if you aren't concerned about finances, the extra income can be a good way to transition from being in the workforce to retirement. It’ll also help with any unexpected expenses you may face as you settle down into the next retirement stage.

Mid-Retirement

This is often when unexpected expenses and overall high costs start to decrease. Over the past few years, you may have downsized, met your main travel goals, or have fewer (if any) dependents. Just because things seem to have settled down doesn't mean you can take a break from financial planning. Inflation changes from year to year and this may affect your retiree benefits. Stay on top of your plan and review important documents like your will and estate. You may want to consider naming someone your financial power of attorney should you be unable to act on your own behalf.

Late Retirement

While the cost of retirement usually goes down when you’re in your 70s, it almost always increases in the later stages of retirement. Health care is expensive and can be hard to plan for. There’s no way to be sure what kind of care you may need and when you may need it. Some will need in-home health care, while others may have to move into an assisted living facility. Check with your health care provider (or who you plan to have as a health care provider when you retire) and ensure that you get proper coverage that makes it possible for you to cover your medical needs.

Summary & Key Takeaways

The stages of retirement will look different to each person, depending on your own finances and goals. But it’s never too early or too late to get started planning for retirement. Formulate a plan for your retirement and then keep up with your plan during the 5 stages of retirement. It may seem overwhelming at times, but knowing your goals and laying out a plan to achieve them will make your retirement better in the long run!